| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

Land Taxation in Palestine before 1948 (Nakba): The Tithe, British Mandate: A Survey of Palestine: Volume I - Page 246. Chapter VIII: Land: Section 4: |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

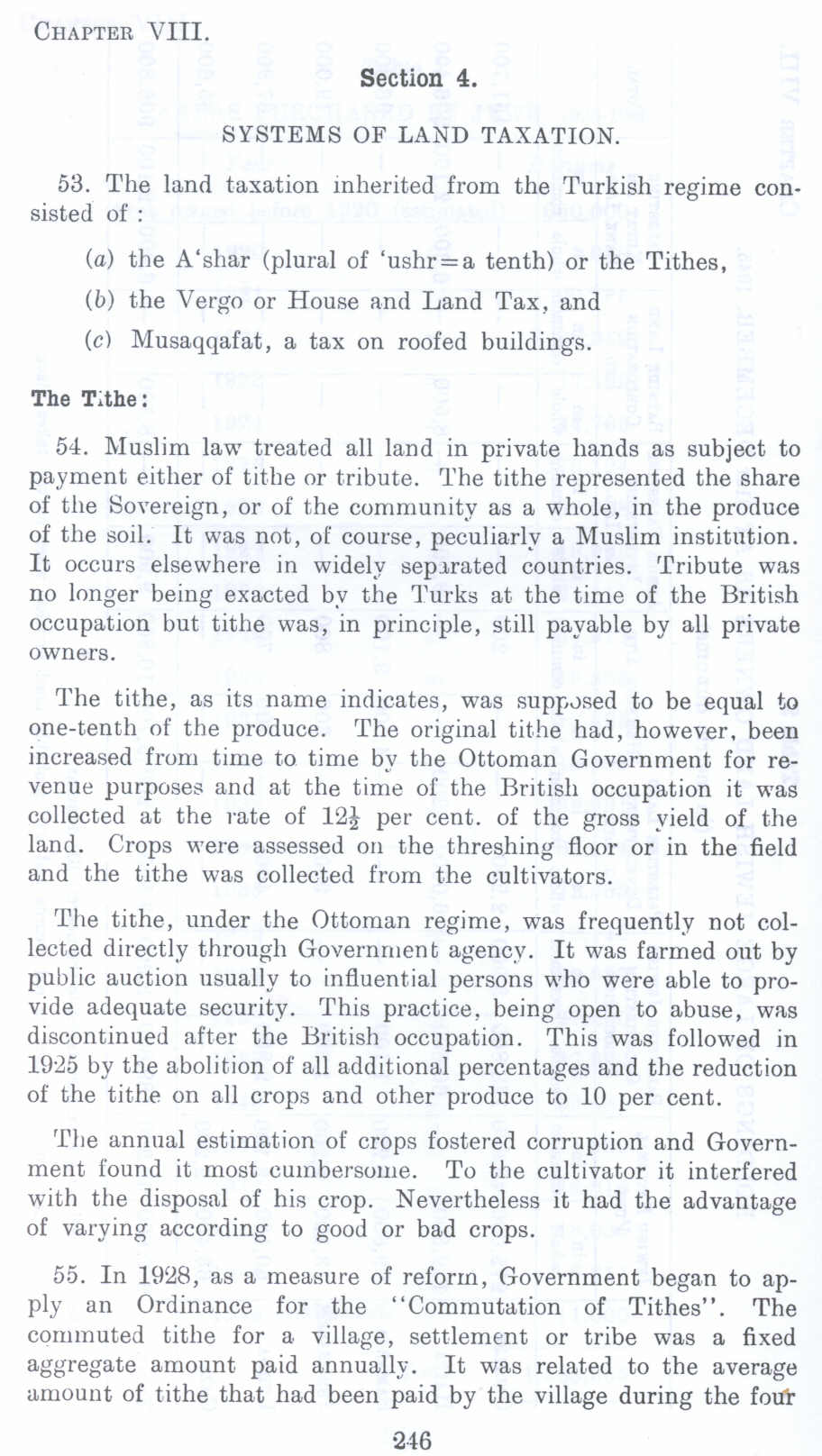

Section 4.

SYSTEMS OF LAND TAXATION.

53. The land taxation inherited from the Turkish regime consisted of :

(a) the A'shar (plural of 'ushr=a tenth) or the Tithes,

(b) the Vergo or House and Land Tax, and

(c) Musaqqafat, a tax on roofed buildings.

The Tithe:

54. Muslim law treated all land in private hands as subject to payment either of tithe or tribute, The tithe represented the share of the Sovereign, or of the community as a whole, in the produce of the soil. It was not, of course, peculiarly a Muslim institution. It occurs elsewhere in widely separated countries. Tribute was no longer being exacted by the Turks at the time of the British occupation but tithe was, in principle, still payable by all private owners.

The tithe, as its name indicates, was supposed to be equal to one-tenth of the produce. The original tithe had, however. been increased from time to time bv the Ottoman Government for revenue purposes and at the ti,,,;e of the British occupation it was collected at the rate of 12! per cent. of the gross yield of the land. Crops were assessed on the threshing floor or in the field and the tithe was collected from the cultivators.

The tithe, under the Ottoman regime, was frequently not collected directly through Government agency. It was fanned out by public auction usually to influential persons who were able to provide adequate security. This practice, being open to abuse, was discontinued after the British occupation. This was followed in 1925 by the abolition of all additional percentages and the reduction of the tithe on all crops and other produce to 10 per cent.

The annual estimation of crops fostered corruption and Government found it most cumbersome. To the cultivator it interfered with the disposal of his crop. Nevertheless it had the advantage of varying according to good or bad crops.

55. In 1928, as a measure of reform, Government began to apply an Ordinance for the "Commutation of Tithes". '!'he commuted tithe for a village, settlement or tribe was a fixed aggregate amount paid annually. It was related to the average amount of tithe that bad been paid by the village during the four

Page 246