| Prev | Next |  |

| Prev | Next |

| PalestineRemembered | About Us | Oral History | العربية | |

| Pictures | Zionist FAQs | Haavara | Maps | |

| Search |

| Camps |

| Districts |

| Acre |

| Baysan |

| Beersheba |

| Bethlehem |

| Gaza |

| Haifa |

| Hebron |

| Jaffa |

| Jericho |

| Jerusalem |

| Jinin |

| Nablus |

| Nazareth |

| Ramallah |

| al-Ramla |

| Safad |

| Tiberias |

| Tulkarm |

| Donate |

| Contact |

| Profile |

| Videos |

Palestinian Banking: (a) Brief history in Palestine before 1948 (Nakba), British Mandate: A Survey of Palestine: Volume II - Page 553. Chapter XIV: Finance: Section 4 |

Disclaimer

The above documents, article, interviews, movies, podcasts, or stories reflects solely the research and opinions of its authors. PalestineRemembered.com makes its best effort to validate its contents.

Post Your Comment

*It should be NOTED that your email address won't be shared, and all communications between members will be routed via the website's mail server.

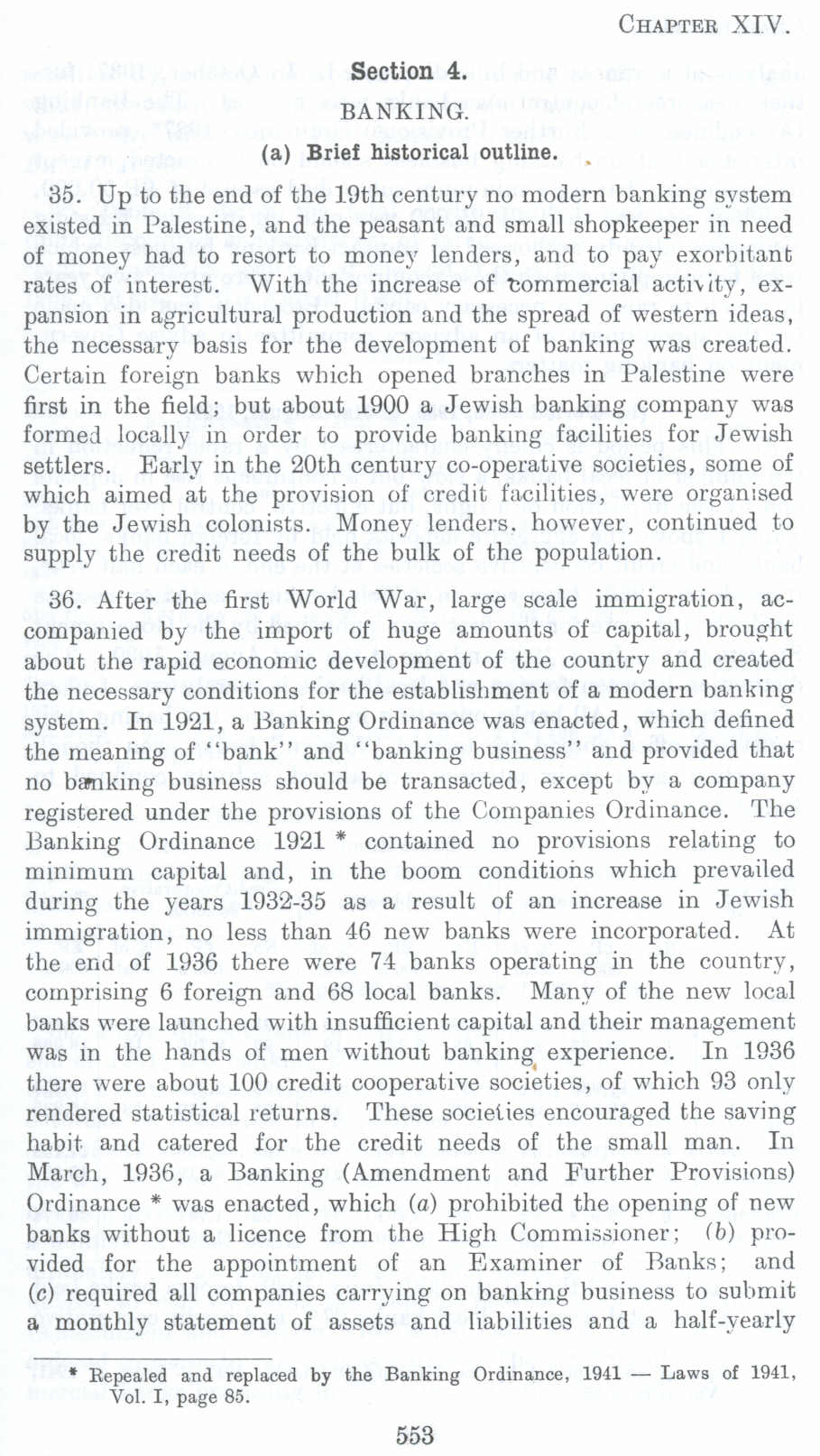

Section 4.

BANKING.

(a) Brief historical outline.

35. Up to the end of the 19th century no modern banking system existed in Palestine, and the peasant and small shopkeeper in need of money bad to resort to money lenders, and to pay exorbitant rates of interest. With the increase of nommcrcial activity, expansion in agricultural production and the spread of western ideas , the necessary basis for the development of banking was created. Certain foreign banks which opened branches in Palestine were first in the field; but about 1900 a Jewish banking company was formed locally in order to provide banking facilities for Jewish settlers. Early in the 20th century co-operative societies, some of which aimed at the provision of credit facilities, were organised by the Jewish colonists. Money lenders. however, continued to supply the credit needs of the bulk of the population.

36. After the first World War, large scale immigration, accompanied by the import of huge amounts of capital, brought about the rapid economic development of the country and created the necessary conditions for the establishment of a modern banking system. In 1921, a Banking Ordinance was enacted, which defined the meaning of "bank" and "banking business" and provided that no banking business should be transacted, except bv a company registered under the provisions of the Companies Ordinance. The Banking Ordinance 1921 * contained no provisions relating to minimum capital and, in the boom conditions which prevailed during the years 1932-35 as a result of an increase in Jewish immigration, no less than 46 new banks were incorporated. At the end of 1936 there were 74 banks operating in the country, comprising 6 foreign and 68 local banks. Many of the new local banks were launched with insufficient capital and their management was in the hands of men without banking experience. In 1!)36 there were about 100 credit cooperative societies, of which 93 only rendered statistical returns. These societies encouraged the saving habit and catered for the credit needs of the small man. In March, 1936, a Banking (Amendment and Further Provisions) Ordinance* was enacted, which (a) prohibited the opening of new banks without a licence from the High Commissioner: lb) provided for the appointment of an Examiner of Banks; and (c) required all companies carrying on banking business to submit a monthly statement of assets and liabilities and a half-yearly

________

* Repealed and replaced by the Banking Ordinance, 1941 - Laws of 1941, Vol. I, page 85.

553